Have you heard the song “Driving Home for Christmas” by Chris Rea? I had never heard it until this year, but it actually has some great advice for driving home for Christmas and so do we. There are not many more days before the holiday so get ready now to make the drive safely. Here are our top 10 tips: Continue reading

Articles Posted in Insurance

Overwhelmed

At this time of year, especially with a shortened season between Thanksgiving and Christmas, it is easy to feel overwhelmed. Shopping, wrapping, addressing, baking and all the other things that need to be squeezed into our already busy schedules can become stressful. But it is important to take a step back, take a deep breath and realize that this type of overwhelmed is rooted in something joyful. We buy the presents, send the cards, bake the cookies, etc. because it is part of a season of joy and festivities. But, there is another type of overwhelmed. Continue reading

Tennessee’s Driving Report Card

I know, it is summer and we should not be talking report cards. But, Allstate is out with its driving report card in which the 200 largest cities across the country are ranked based on their driving safety record. The report considers things such as claim history and the number of hard braking incidents for every 1000 miles. This year, Allstate has also identified the 15 riskiest roads based on number of accidents. So did any Tennessee cities or roads make the list? Read on to find out. Continue reading

Understanding Tennessee Auto Insurance

People often buy insurance on their motor vehicle and think that they have “full coverage.” In fact, many people who have “full coverage” do not have the types of insurance they need and even more frequently do not have the amount of coverage they need.

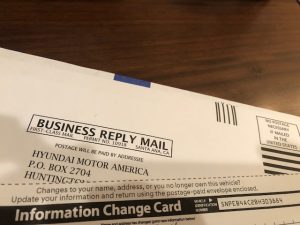

We suggest that you find your “declarations” page from your vehicle insurance policy and read it in conjunction with the remainder of this post. The declarations page is sent to you with each policy renewal and shows what type of coverage you have for each vehicle insured under the policy. It also shows the cost of each type of coverage.

Here is an explanation of the various types of coverage:

Liability Coverage

Liability coverage is required by law in Tennessee and most other states. Liability insurance exists to help cover damages for injuries to others for which you become legally responsible resulting from a covered accident. In other words, this insurance protects you in the event you cause or are alleged to have caused a wreck that has injured or killed another person. Continue reading

Tennessee Drivers Are the Second Worst in the Nation

We have a lot to be proud of in the Volunteer State. We make the best whiskey. We are home to the Smokey Mountains, the Vols, the Predators. Nobody does music like our State from country music in Nashville to the blues in Memphis. I could go on and on. But apparently, one thing we stink at is driving – according to a recent study. We have all seen atrocious driving on our streets, highways and interstates, but read on to learn exactly how we became the first-runner-up in this less than esteemed category and who was the winner (or loser in this particular case) Continue reading

Do You Have The Right Insurance? And, Do You Have Enough?

Every single day, an attorney at The Law Offices of John Day, P.C. has to tell a client they are not going to receive any money for their injuries or the death of a loved one or they are going to receive a lot less than they should. Every. Single. Day. And, we hate it. Sometimes, we have to tell them this simply because they do not have a case. In other words, there was a terrible accident but no one is to blame under the law. But more often than not, we have to tell people they are not going to recover or they are going to recover substantially less than they should because there is no insurance or not enough insurance.

While you can’t make other people buy insurance, you can still protect yourself from people and companies who either do not have it or do not have enough. And, of course, you can review your own insurance to make sure you are protected in the event you make a mistake and cause an accident. Here are 5 incredibly important questions you should ask yourself, and more importantly, your insurance agent: Continue reading

If These 2 Facts Don’t Make You Buy Uninsured Motorist Coverage, Nothing Will

Tennessee is one of the top five states for uninsured motorists. Roughly 20% of the vehicles on our roads are not covered by insurance. Second, 46.8% of all ride-share drivers do not have ride-share insurance. So why are these two facts so scary? Continue reading

How Are You Doing On That New Year’s Resolution?

Almost everyone makes them, and most of us quickly break them. In fact, only 8% of New Year’s resolutions are kept and 80% of us can’t even make it until February. So if you have already broken your New Year’s resolutions, you have plenty of company. But here is some good news: we have three EASY things you can do in the New Year that will make you and your family safer and better protected, and none of them involve losing weight. Continue reading

DOs and DONT’s: The Legal Version

You may have seen those fashion magazines where they have pictures of people wearing clothes the right way and the wrong way. On the wrong way pictures, they usually put a black box over the person’s face to hide the shame of wearing a meat dress or tights as pants. At The Law Offices of John Day, P.C., we wanted to give you some legal DOs and DON’Ts. Continue reading

Dogs: Man’s Best Friend (Usually)

Roughly 44% of all U.S. households have a dog. Ours has a tri-color King Charles Cavalier named Lincoln (pictured above). Lincoln and most other dogs are wonderful companions, protectors, and exercise buddies, but when they want to dogs can inflict a lot of damage primarily due to their bite pressure. So just how strong is a dog’s bite? Continue reading

Tennessee Injury Law Center

Tennessee Injury Law Center